I may get commissions for purchases made through links in this post.

Do you want to get rich or create more freedom? Living beneath your means is the way to go according to these frugal millionaires. They know that living a modest life is key to accummulating and maintaining financial wealth. These folks are aware that happiness is not in extravagant status symbols and exuberant display of wealth.

Did you know for example that Prince Rainier of Monaco has a habit of buying sets of socks in the same color and design so that missing or worn out socks don’t result in a lost pair? To some this may come off as penny pinching but it makes sense if you realize that frugal living is a mindset. It’s like eccentric billionaire John D. MacArthur said, “Being frugal is just another way of being a good businessman.”

1. Frugal living is rewarding (in various ways)

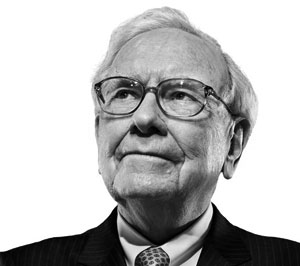

Warren Buffett is the perfect example of how fullfillment isn’t met by accumulating trappings of wealth such as yachts, jets and mansions.

His message basically is, if you have the means, start doing what you love instead of buying more luxury items. The Oracle of Omaha doesn’t own a yacht or mansion because, as he puts it, “Most toys are just a pain in the neck.”

You know, like that famous movie quote, “the things you own end up owning you.

In a similar fashion, one of Buffett’s mantras “The first rule of investing is don’t lose money; the second rule is don’t forget Rule No. 1.”Because, if you buy things you do not need, soon you will have to sell things you need.

One of the world’s richest sure walks the talk as he hasn’t changed his lifestyle much since he became this rich. Buffett, for example, still lives in the modest Omaha, Nebraska house he bought about 50 years ago for $31,500.

His advice? Instead of having the burden to pay for the expense and maintenance of belongings, spend more time smelling the roses. Enjoy your time with family and friends and enjoy the little things in life. A modest living standard is more likely to offer you freedom, joy, and security. A simple life is a happy life.

“Success is really doing what you love and doing it well. It’s as simple as that. Really getting to do what you love to do everyday – that’s really the ultimate luxury…your standard of living is not equal to your cost of living.”

2. Find your own way in being frugal and save as much as you can

Having the desire to be frugal is nice and all but what about the husband or misses? Is he or she on the same boat? Does he or she feel okay restraining from that shiny, limited edition Maserati or the penthouse with walk-in closet the size of a neigbourhood mall?

Or perhaps you yourself find it unbearable to live extremely frugally while all that money is rolling in.

You don’t necessarily have to heat your oatmeal on the office radiator. Nor do you have to trade worn clothes with a friend who has the same size in order to get an whole ‘new’ wardrobe for free like Rose Fitzgerald Kennedy did. The key is to be sparing in your own way. There’s no set rule.

Some people thrive at being an extreme tightwad while others just love finding little treasures at thrift stores. Some get a kick out of coupon clipping while other frugalistas have a taste for growing their own produce or living in a tiny home. Whatever your approach is, choose a style that fits your personal wants and needs and while you’re at it, save as much as you can.

Matthew Tuttle, founder of Tuttle Wealth Management says,

“I’m not a big fan of budgets. I’m not a big fan of trying to impose that discipline on someone who just can’t do it. I also find a lot of times spouses vehemently disagree when it comes to budgeting. What I am much more a fan of is, save as much as you can, and if you’re saving as much as you can, as long as you’re not going into debt, then I don’t necessarily care where you’re spending your money.”

3. Avoid debt at all costs

Your expenses are your chains and debt is a heavy iron dungeon ball and chain. Nowadays, debt is often perceived as normal but it is limiting your freedom enormously. Think twice about where you drop your dough on and scratch your head like you’ve got lice before getting a loan.

You would be surprised if you knew how often people flaunting wealth are actually over their heads in debt. Millionaires on the other hand, are often likely to be thrifty.

Derek Sivers, founder of CD Baby said on INC.com

“I’ve always been very debt-averse. I don’t like being in debt at all, even on the small level. I never bought anything with a credit card unless I had that much money in the bank. The credit card was just a convenience. I never went into negative debt on a credit card, even as a teenager, because I just hated that feeling. They say that there are two ways to be rich: One is getting more money, and the other one is lowering your expectations, lowering your needs.”

4. Have some self-reflection

If you really think about it, buying a fourth sports car or your third mansion while at the same time people are starving may seem somewhat irky. I mean, when you take a look at the large scheme of things, there’s a slight twinge of something amiss don’t you think?

It’s not that people should not be able to decide what they want to do with their own money. We’re not to judge the moral aspects of obtaining exorbitant riches while leaving fellow humans to their fate. But if you have the means you will probably want to help others out as well. That is, unless you’re a twat.

It’s like Stanford professor David Cheriton, the billionaire who cuts his own hair says about living like a billionaire:

“I’m actually quite offended by that sort of thing, these people who build houses with 13 bathrooms and so on, there’s something wrong with them.” (Canada.com.)

With an estimated net worth of $1.3 billion from Google shares, Cheriton called himself “spoiled” going on a windsurfing vacation in Hawaii once in a while. In a recent interview with Forbes magazine he revealed that his biggest recent splurge was a 2012 Honda Odyssey for the kids.

5. The more you accumulate, the more good you can do

It makes me frown when I hear people say, “well, having 10 million dollar on my bank account would suffice for me.”

Aren’t you aware of the harrowing inequality still rampant on our planet? Didn’t it come to mind that the more you can get your greasy paws on (and not spend it on useless stuff) the better, so you can direct it to people who really need it?

Too many rich folks don’t do this. (The wealthiest Americans donate 1.3 percent of their income; the poorest, 3.2 percent.) But if you had the money you could. Which is why I have such a high esteem for Leonardo Dicaprio.

The genius actor’s prudent lifestyle allows him to be selective in which roles he takes sparing us from the crappy movies many good actors tend to make on the side. This admirable trait aside, the man is a begeistered activist.

Apart from purchasing a $2.5 million island near Belize in 2005, DiCaprio tends to live sparingly.

“I don’t pay lavish expenses. I don’t fly private jets. I still have only one car, and that’s a Toyota Prius. I don’t spend money on a lot. Money is very important to me because it allows me the freedom to choose what I want to do as an actor and most importantly because I want to accumulate enough so that one day I can do something really great and beneficial for other people, for the environment or for children.”

6. Being frugal is about more than being trendy

By stating publicly, “I exclusively buy used clothes,” Shailene Woodley contributed to setting the living modestly trend. Yup, Frugal is the new Black.

It’s great that frugality isn’t something to be ashamed about anymore. It is hip. And smart too, considering the fact that 43% of American families spend more than they earn (According to a Federal Reserve Board study)

The actress told InStyle she hadn’t “bought a piece of clothing in a year or two.”

A big fan of thrift stores, she told the magazine her wardrobe contains a modest 3 long-sleeve shirts, 7 short-sleeve shirts, 2 tank tops, and a few pairs of leggings, jeans, and overalls

Compare that with the o so common closet with piles of unused new clothes with price tags still attached. You know what I mean, you probably have a friend like that.

Did you know that another celebrity known for her taste for thrift and outlet stores is the Duchess of Cambridge Kate Middleton?

What can be learned here ?

Don’t let yesterdays consumerist-instigated stigmatisation hold you back. Living sparingly is not about being hip, it’s about being free. Free to choose and being free because of less financial restraints.

Drawing Warren Buffet (featured image) by Guillermo Prestegui.

Add Comment